Next: Signals with segments removed

Up: Effect of nonstationarities on

Previous: Introduction

Method

Using a modified Fourier filtering method[63], we generate stationary

uncorrelated, correlated, and anti-correlated signals  (

(

) with a standard

deviation

) with a standard

deviation  . This method consists of the following steps:

. This method consists of the following steps:

(a) First, we generate an uncorrelated and Gaussian distributed sequence

and calculate the Fourier transform coefficients

and calculate the Fourier transform coefficients  .

.

(b) The desired signal  must exhibit correlations, which are

defined by the form of the power spectrum

must exhibit correlations, which are

defined by the form of the power spectrum

|

(1) |

where  ) are the Fourier transform coefficients of

) are the Fourier transform coefficients of  and

and  is the correlation exponent. Thus, we generate

is the correlation exponent. Thus, we generate  ) using the following

transformation:

) using the following

transformation:

![\begin{displaymath}

u(q)=[S(q)]^{1/2}\eta(q),

\end{displaymath}](img68.png) |

(2) |

where  is the desired power spectrum in Eq. (1).

is the desired power spectrum in Eq. (1).

(c) We calculate the inverse Fourier transform of  ) to obtain

) to obtain

.

.

We use the stationary correlated signal  to generate signals with

different types of nonstationarity and apply the DFA method[3] to quantify

correlations in these nonstationary signals.

to generate signals with

different types of nonstationarity and apply the DFA method[3] to quantify

correlations in these nonstationary signals.

Next, we briefly introduce the DFA method, which involves the following

steps[3]:

(i) Starting with a correlated signal

, where

, where

and

and  is the length of the signal,

we first integrate the signal

is the length of the signal,

we first integrate the signal  and obtain

and obtain

![$y(k)\equiv\sum_{i=1}^{k}[u(i)-\langle u \rangle]$](img72.png) , where

, where

is the mean.

is the mean.

(ii) The integrated signal  is divided into boxes of equal

length

is divided into boxes of equal

length  .

.

(iii) In each box of length  , we

fit

, we

fit  , using a polynomial function of order

, using a polynomial function of order  which represents the

trend in that box. The

which represents the

trend in that box. The  coordinate of the fit line in each box is denoted by

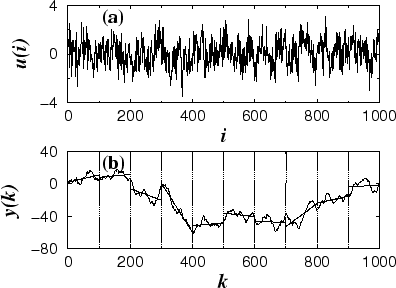

coordinate of the fit line in each box is denoted by  (see

Fig. 1, where linear fit is used). Since we use a polynomial

fit of order

(see

Fig. 1, where linear fit is used). Since we use a polynomial

fit of order  , we

denote the algorithm as DFA-

, we

denote the algorithm as DFA- .

.

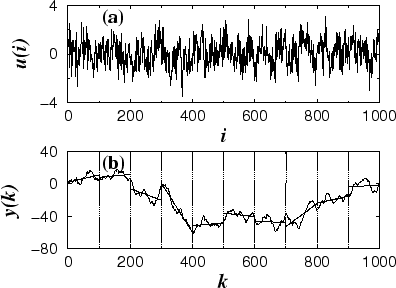

Figure 1:

(a) The correlated signal  .

(b) The integrated signal:

.

(b) The integrated signal:

![$y(k)=\sum_{i=1}^k[u(i)-\langle u

\rangle]$](img78.png) . The vertical dotted lines indicate a box of size

. The vertical dotted lines indicate a box of size

, the solid straight lines segments are the estimated

linear ``trend'' in each box by least-squares fit.

, the solid straight lines segments are the estimated

linear ``trend'' in each box by least-squares fit.

|

(iv) The integrated signal  is detrended by

subtracting the local trend

is detrended by

subtracting the local trend  in each box of length

in each box of length  .

.

(v) For a given box size  , the root mean-square (r.m.s.)

fluctuation for this integrated and detrended signal is

calculated:

, the root mean-square (r.m.s.)

fluctuation for this integrated and detrended signal is

calculated:

![\begin{displaymath}

F(n)\equiv\sqrt{{1\over {N_{max}}}\sum_{k=1}^{N_{max}}[y(k)-y_n(k)]^2}.

\end{displaymath}](img80.png) |

(3) |

(vi) The above computation is repeated for a broad range of scales

(box sizes  ) to provide a relationship between

) to provide a relationship between  and the box

size

and the box

size  .

.

A power-law relation between the average root-mean-square

fluctuation function  and the box size

and the box size  indicates

the presence of scaling:

indicates

the presence of scaling:

. The fluctuations can be

characterized by a scaling exponent

. The fluctuations can be

characterized by a scaling exponent  , a self-similarity

parameter which represents the long-range power-law

correlation properties of the signal. If

, a self-similarity

parameter which represents the long-range power-law

correlation properties of the signal. If  , there is no correlation

and the signal is uncorrelated (white noise); if

, there is no correlation

and the signal is uncorrelated (white noise); if

, the signal is anti-correlated; if

, the signal is anti-correlated; if

, the signal is correlated[64].

, the signal is correlated[64].

We note that for anti-correlated signals, the scaling exponent obtained

from the DFA method overestimates the true correlations at small scales[61].

To avoid this problem, one needs first to integrate the original anti-correlated

signal and then apply the DFA method[61]. The correct scaling

exponent can thus be obtained from the relation between  and

and  [instead of

[instead of  ].

In the following sections, we first integrate the signals under

consideration, then apply DFA-2 to remove linear trends in these

integrated signals. In order to provide a more accurate estimate of

].

In the following sections, we first integrate the signals under

consideration, then apply DFA-2 to remove linear trends in these

integrated signals. In order to provide a more accurate estimate of  ,

the largest box size

,

the largest box size  we use is

we use is  , where

, where  is the

total number of points in the signal.

is the

total number of points in the signal.

We compare the results of the DFA method obtained from the nonstationary

signals with those obtained from the stationary signal  and examine

how the scaling properties of a detrended fluctuation function

and examine

how the scaling properties of a detrended fluctuation function  change

when introducing different types of nonstationarities.

change

when introducing different types of nonstationarities.

Next: Signals with segments removed

Up: Effect of nonstationarities on

Previous: Introduction

Zhi Chen

2002-08-28

![]() (

(

![]() ) with a standard

deviation

) with a standard

deviation ![]() . This method consists of the following steps:

. This method consists of the following steps:

![]() and calculate the Fourier transform coefficients

and calculate the Fourier transform coefficients ![]() .

.

![]() must exhibit correlations, which are

defined by the form of the power spectrum

must exhibit correlations, which are

defined by the form of the power spectrum

![]() is detrended by

subtracting the local trend

is detrended by

subtracting the local trend ![]() in each box of length

in each box of length ![]() .

.

![]() , the root mean-square (r.m.s.)

fluctuation for this integrated and detrended signal is

calculated:

, the root mean-square (r.m.s.)

fluctuation for this integrated and detrended signal is

calculated: